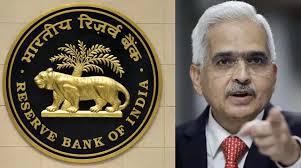

Daily Current Affairs / RBI Guv Shaktikanta Das launches PRAVAAH, Retail Direct mobile app and FinTech Repository

Category : Business and economics Published on: May 30 2024

India has emerged as the world’s third most competitive country in artificial intelligence, according to Stanford University’s Global AI Vibrancy Tool.

Read More....Lakshadweep hosted its first-ever investors’ meet on fisheries and aquaculture to promote the blue economy, with investment proposals worth about ₹519 crore.

Read More....The Union Cabinet has approved the Census of India 2027 at a cost of ₹11,718.24 crore, marking India’s first digital-first census exercise.

Read More....UNESCO has added Pakistan’s ancient clay musical instrument Boreendo from Sindh to the Urgent Safeguarding List due to the risk of extinction.

Read More....India’s National Film Heritage Mission has digitised and restored 1,469 films, preserving 4.3 lakh minutes of cinematic heritage across all languages.

Read More....AIIMS Delhi conducted India’s first domestic stroke device trial under the GRASSROOT study, approving the indigenous Supernova brain stent for routine use.

Read More....India ranks among the world’s most overworked nations, with employees averaging 45.7 hours per week, according to ILO 2024.

Read More....Andhra Pradesh wins the National Energy Conservation Award 2025 for the fourth consecutive year, leading in energy efficiency across sectors.

Read More....India’s forex reserves rise by USD 1.033 billion to USD 687.26 billion, strengthening rupee and macroeconomic stability.

Read More....Siliserh Lake in Rajasthan’s Alwar district has become India’s 96th Ramsar site, highlighting its ecological and historical significance.

Read More....